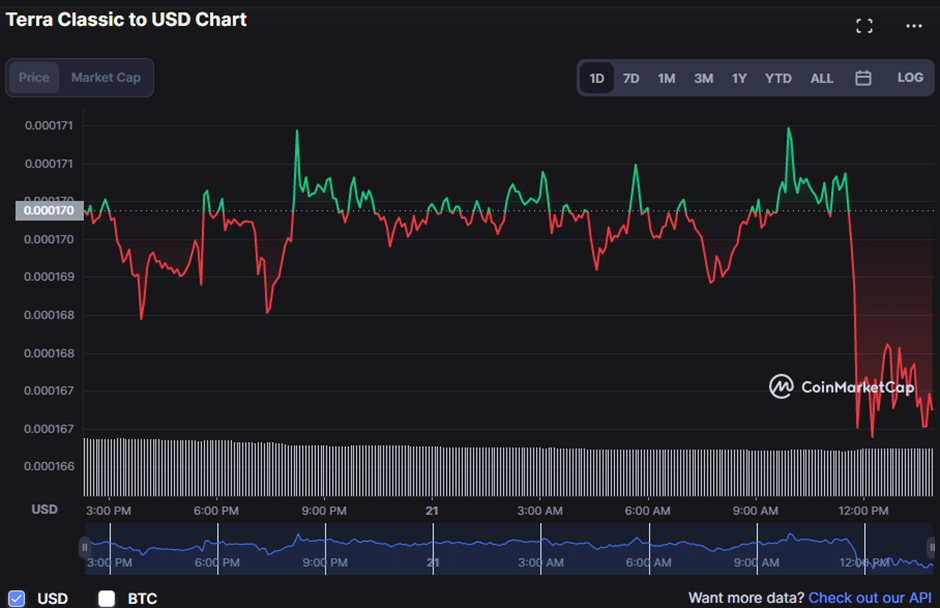

Over the past 24 hours, Terra Classic (LUNC) has seen a fierce battle between bulls and bears. The latter emerged victorious and sent the price down to intraday lows of $0.0001667 at the time of writing. Bears have pushed the price of LUNC down to $0.0001675, down 1.41% from the previous repeat.

During the downturn, the market capitalization decreased 1.40% to $990,530,797 and the 24-hour trading volume decreased 17.31% to $80,577,318. This decline shows that bears are in control of the market trend. And if it continues to push down, LUNC is likely to fall a bit more.

This is because Stochastic RSI is trending below the signal line with a value of 16.80, which indicates that the current negative momentum in LUNC continues. Further price declines may be on the horizon in the near term. This move hints that the market is oversold and is likely to lead to a possible reversal. After a short period of consolidation, the market is preparing to move in an upward direction. This level is a potential buying opportunity for traders hoping to profit from a momentum reversal.

The TRIX indicator is trending in the negative zone with a value of -1.03, which indicates that the market is in oversold territory. And there is a chance that the market will reverse forward. However, from the current market situation Traders may consider this move as a possible buying opportunity in the near term.

Bull Bear Power (BBP) trended south in the negative zone with a value of -0.000003570, strengthening the assumption that the market is in a short-term reversal. Since negative values indicate more selling pressure than buying pressure, traders should try to profit from the reverse momentum and start buying at these lower levels.

Since the technical rating indicator on the LUNC price chart reflects “Strong Sell” with a value of -0.51, the negative sentiment appears to be in control. This display shows that the bears have gained control of the market. And the negative trend will continue.

The True Strength Index (TSI) is below the signal line with a reading of -10.8469, which confirms the market’s negative sentiment as it indicates considerable selling pressure.

This move warns traders that the negative trend in LUNC is likely to continue until TSI returns to and above the signal line. This highlights the market’s bearishness. And traders should wait to open any positions on LUNC until these technical indicators turn positive.

Indications suggest that a downtrend is building. This raises doubts about the LUNC market’s ability to reverse its downtrend.