It may have seemed like forever ago when the price of Bitcoin (BTC) traded below $18,000, but in reality 40 days ago it was basically Cryptocurrency traders tend to have short-term memories. And more importantly They attach less importance to negative news during an uptrend. A good example of this behavior is BTC increasing 15% since February 13 despite a wave of bad news in the crypto market.

For example, on February 13, the New York State Department of Financial Services (NYDFS) ordered Paxos to cease production of Paxos’s dollar-pegged stablecoin Binance USD (BUSD). Reuters reported on January 16 that bank accounts controlled by Binance.US transferred more than $400 million to trading firm Merit Peak, which is thought to be an independent entity controlled by Binance CEO Changpeng Zhao.

The wave of regulatory pressure continued on Feb. 2. On Oct. 17, the U.S. Securities and Exchange Commission (SEC) announced a $1.4 million settlement with a former NBA player. Paul Pierce for allegedly promoting false and misleading statements about the EthereumMax token on social media.

No adverse event can destroy investors’ optimism. after weak economic data signaled the Federal Reserve (FED) had less room to raise interest rates. The Philadelphia FED Manufacturing Survey shows a 24% decline on 2 Feb 16 and US housing starts increased by 1.31 million compared to the previous month. This is lighter than the expected 1.36 million.

Let’s take a look at Bitcoin derivatives metrics to better understand how professional traders are faring in the current market conditions.

Stablecoin demand in Asia continues ‘modest’

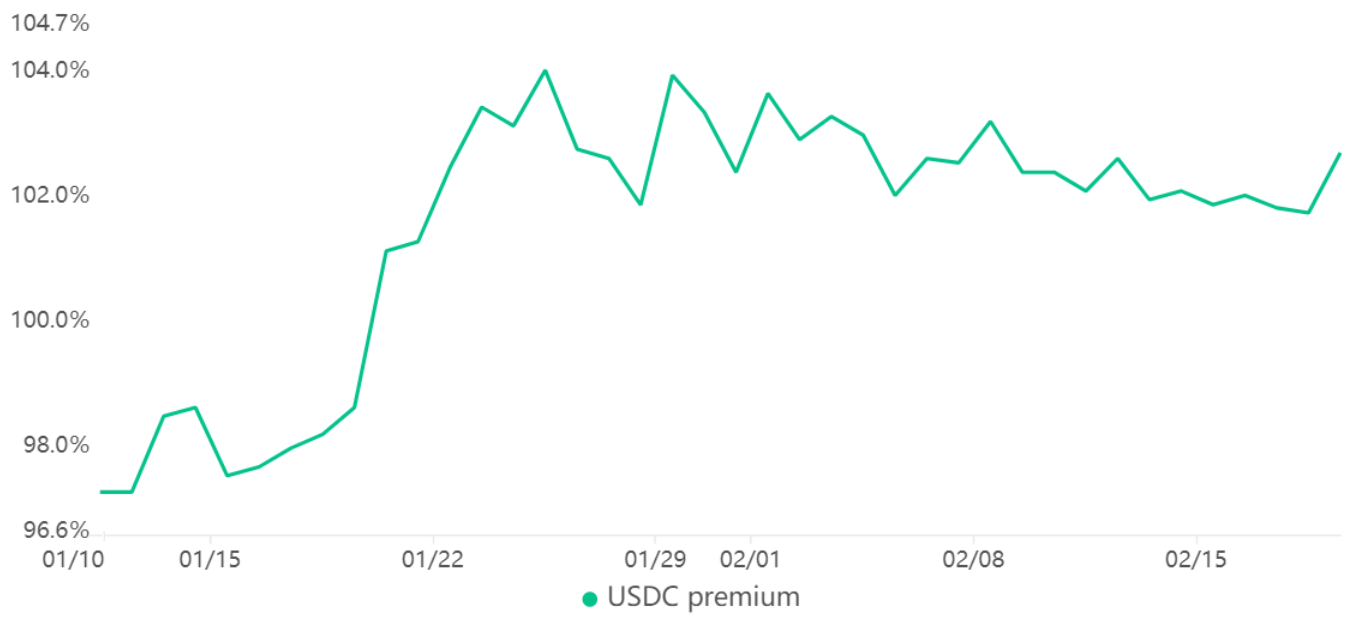

Traders should refer to the USD Coin (USDC) premium to gauge demand for cryptocurrencies in Asia. The index measures the difference between Chinese peer-to-peer stablecoin trading and the US dollar.

Excessive demand for cryptocurrencies can push the indicator above its fair value of 104%. On the other hand, stablecoin market offers are flooded during bear markets, causing discounts of 4% or higher.

The USDC premium is currently at 2.7%, which is flat from the previous week on 2 Feb 13 and indicates little demand for stablecoin purchases in Asia. However, the positive indicator shows that traders Retailers are not alarmed by the latest buzz or Bitcoin’s decline at $25,000.

Future premium shows good momentum

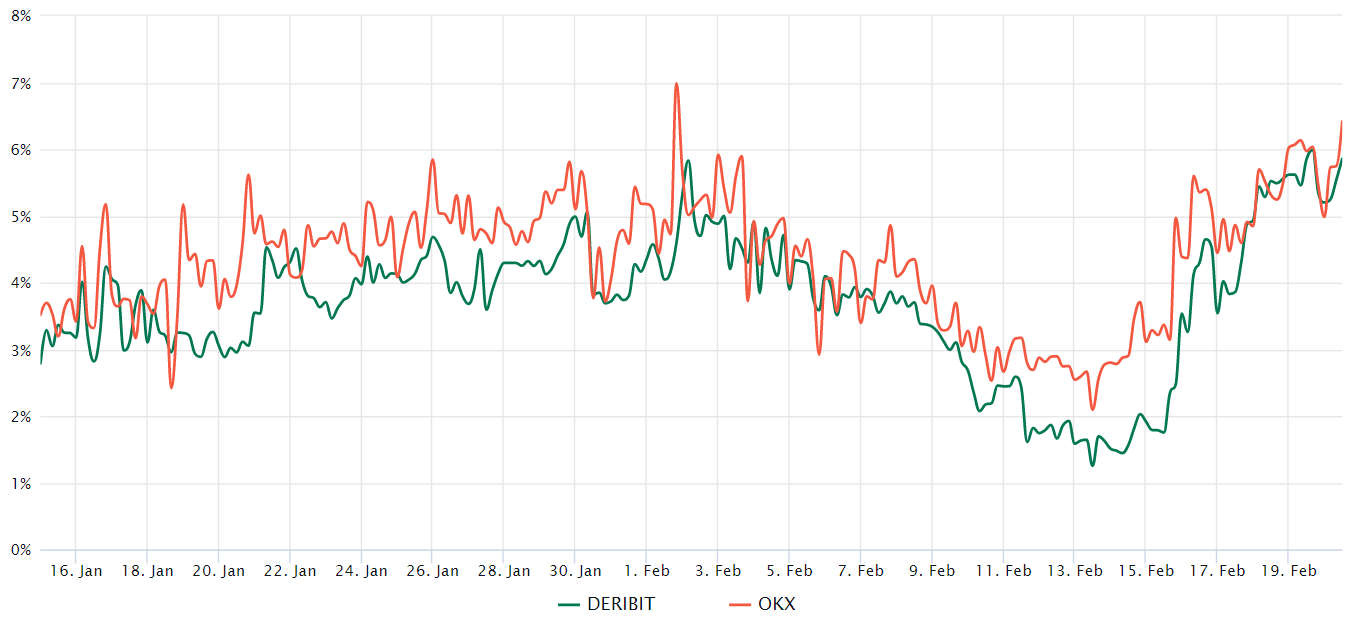

Retail traders often avoid quarterly futures because their prices differ from the spot market. Meanwhile Professional traders prefer these instruments because they protect against fluctuations in funding rates in perpetual futures contracts.

The two-month forward annual premium should trade between 4% and 8% in a healthy market to cover the costs and risks involved. Therefore, when futures trade below this range, This indicates that there is a lack of confidence from leverage buyers. This is a bearish indicator.

The chart shows bullish momentum as the Bitcoin futures premium breached the 4% neutral threshold in February 16. This move represents a return to the neutral to bullish sentiment that was in effect until the start of the month. February As a result, it is clear that professional traders are more comfortable with trading Bitcoin prices above $24,000.

The limited impact of regulatory action is a positive sign.

While Bitcoin’s price increase of 15% since February 13 is encouraging, the regulatory news flow has been primarily negative. Investors are excited about the FED’s waning ability to control the economy and keep inflation in check, so we can understand how those bear market events failed to crush the spirits of cryptocurrency traders.

Ultimately, correlation with the S&P 500 50-day futures remains high at 83%. Correlation statistics above 70% indicate that the asset classes are moving in tandem. This means that the macroeconomic situation tends to determine the overall trend.

At the moment, both retail and professional traders are showing signs of confidence based on Stablecoin Premium and BTC Futures metrics, so the odds are in favor of the rally continuing. This is because the lack of price correction generally marks a bull market even in the event of a bearish event. especially regulatory events

This article does not contain investment advice or recommendations. Every investment and trading involves risk. And readers should do their own research when making decisions.